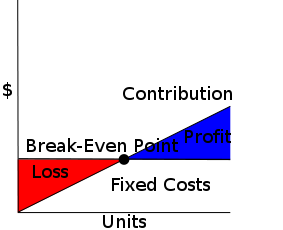

Cost-Volume-Profit diagram, showing Break-Even Point as point where Contribution equals Fixed Costs.

I've included a brief summary of these financial terms to help you in your efforts:

1. Financial Statements: Used as a reference for Profit & Loss Statement (which shows revenues and expenses and your income or loss) and the Balance Sheet (which reflects your assets, liabilities, and owner's equity).

Additional financial reports such as Cash Flow, Break Even Analysis, Sources and Uses of Working Capital, and Financial Ratios Analysis are also often included.

2. Debt or Equity Capital: Describes what kind of capital you are seeking. Debt is usually in the form of a loan, promissory note, mortgage or other legal instrument. Equity is an ownership position in the business.

3. Rate of Return (Yield): The primary purpose of investing your money or getting other people's money is to earn a return on capital. This number indicates what profit or interest investors or lenders receive for investing. Prior to approaching any source for funds, you should know what kind of yields they are seeking.

4. Cash Flow: This is the life blood of a company. Cash flow is the generation of funds available to pay expenses and returns to investors or lenders. Cash flow reflects the timing and amount of inflow and outflow of funds.

5. Working Capital: Usually, this figure represents total assets that will be converted to cash within a year minus liabilities that must be paid within a year.

6. Collateral: This is property accepted as a secondary source of repayment of a loan or other obligation.

7. Break Even Analysis: A method of assessing a company's profit potential downside risk. Expenses should be separated into variable costs (i.e. labor, materials, commissions) and fixed costs (i.e. rent, utilities, salaries, insurance, etc.). With these costs and estimated revenues per unit, you can determine how much product/service must be sold to cover costs.

At this volume, your company incurs neither a profit nor loss.The break even analysis is an important tool to illustrate the effects of product price changes, cost increases or a reduction in demand on the company's profitability.

8. Margin: The difference between revenues received and expenses incurred and commonly expressed as a percentage or dollar amount. Gross margin is the difference between total sales revenue and total costs of goods sold. Net margin is the difference between total sales revenue and all costs associated with producing goods, including administration, taxes, and other overhead expenses.

9. Leverage: The ability to borrow a larger amount of money than a company has invested in property or assets.

10. Fixed Cost: A cost that remains unchanged even with variations in output.

11. Variable Cost: The cost of production that vary directly in proportion to the number of units produced.

Do you think this information was helpful?

Leave your comments below.